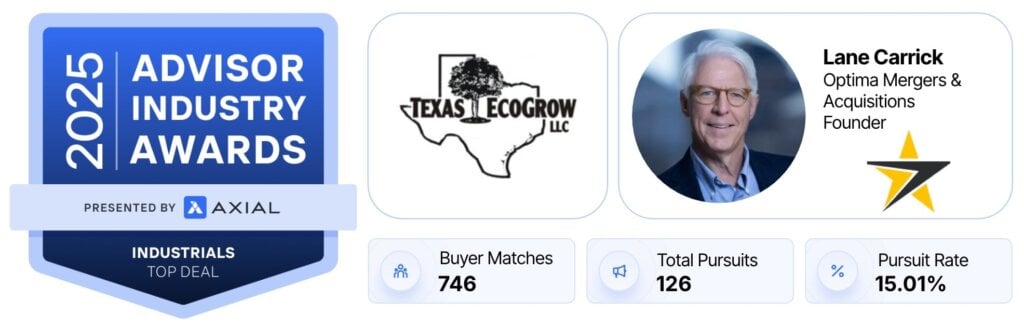

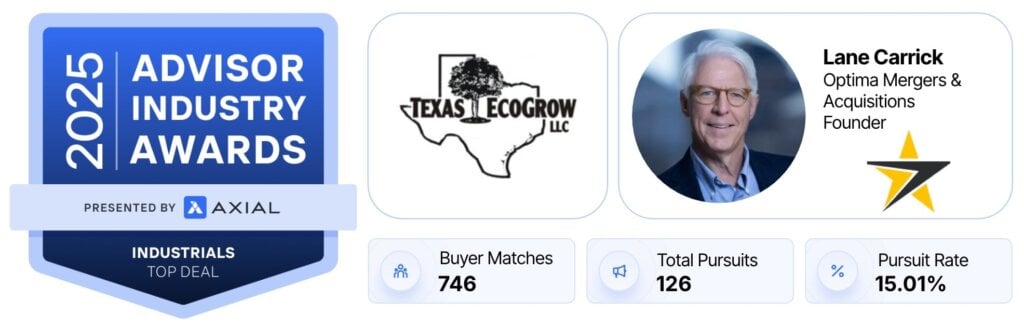

Dallas, Texas – February 10, 2026 – Optima Mergers & Acquisitions is pleased to announce that it has been honored at the 2025 Advisor Industry Awards, presented by Axial, for its leadership in the sale of Texas EcoGrow to NextGen Growth Partners. The transaction was recognized as a premier deal in the Industrials category, marking a significant achievement in the lower middle-market M&A landscape.

The transaction involved the sale of Texas EcoGrow, a commercial landscaping and outdoor services company specializing in environmentally responsible soil health and sustainable land use. Represented by Lane Carrick of Optima M&A, the company was acquired in February 2025 by NextGen Growth Partners, a Chicago-based private equity firm.

The deal’s unique focus on environmental sustainability attracted significant market interest. After being brought to market via the Axial platform in March 2024, the process generated:

- 746 recommended buyers.

- 126 active pursuits.

- 3 nominations for the 2025 M&A Advisor Awards, including Private Equity Deal of the Year and M&A Deal of the Year ($10M–$25M category).

“This was a challenging deal for a number of reasons, and I’m proud of our team for getting it to the finish line,” said Lane Carrick of Optima Mergers & Acquisitions. “It was our first deal for which we sourced a buyer through Axial, and we look forward to many more of these outcomes.”

The acquisition provides Texas EcoGrow with a strategic financial partner equipped to scale its sustainable operating model. The success of this transaction underscores Optima M&A’s ability to navigate complex industrial deals and connect specialized service providers with the right capital partners.

About Optima Mergers & Acquisitions

Optima Mergers & Acquisitions provides expert advisory services to middle-market business owners, specializing in strategic sales and acquisitions. With a commitment to maximizing value and ensuring smooth transitions, Optima helps companies navigate the complexities of the M&A process across a variety of sectors.